💰 FREE LIVE CLASS THIS SUNDAY

HOW TO LEGALLY BULLY THE BUREAUS OUT OF A 700 SCORE IN 30 DAYS

Learn the consumer law secrets to remove any negative items to get a credit score of 700 in 30 days

SUNDAY 7PM EST

Learn the consumer law secrets to remove any negative items to get a credit score of 700+ in 30 days

SUNDAY 7PM EST

Here Is Exactly What We Will Cover

How To Use The Law To Spot Violations That's On Everyone’s Report

This 1 Secret Method That Gets Removals Fast & Compliantly

How To Structure Your Report To Acquire $50 - 250k For Funding

How To Acquire 0% Business Funding & No Doc Loans & Lines Of Credit

Here Is Exactly What We Will Cover

How To Use The Law To Spot Violations That's On Everyone’s Report

This 1 Secret Method That Gets Removals Fast & Compliantly

How To Structure Your Report To Acquire $50 - 250k For Biz Funding

How To Acquire 0% Business Funding & No Doc Loans & Lines Of Credit

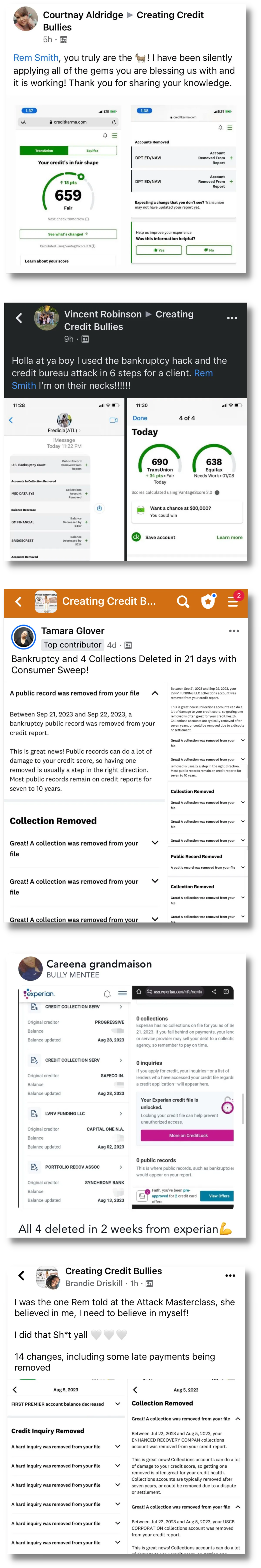

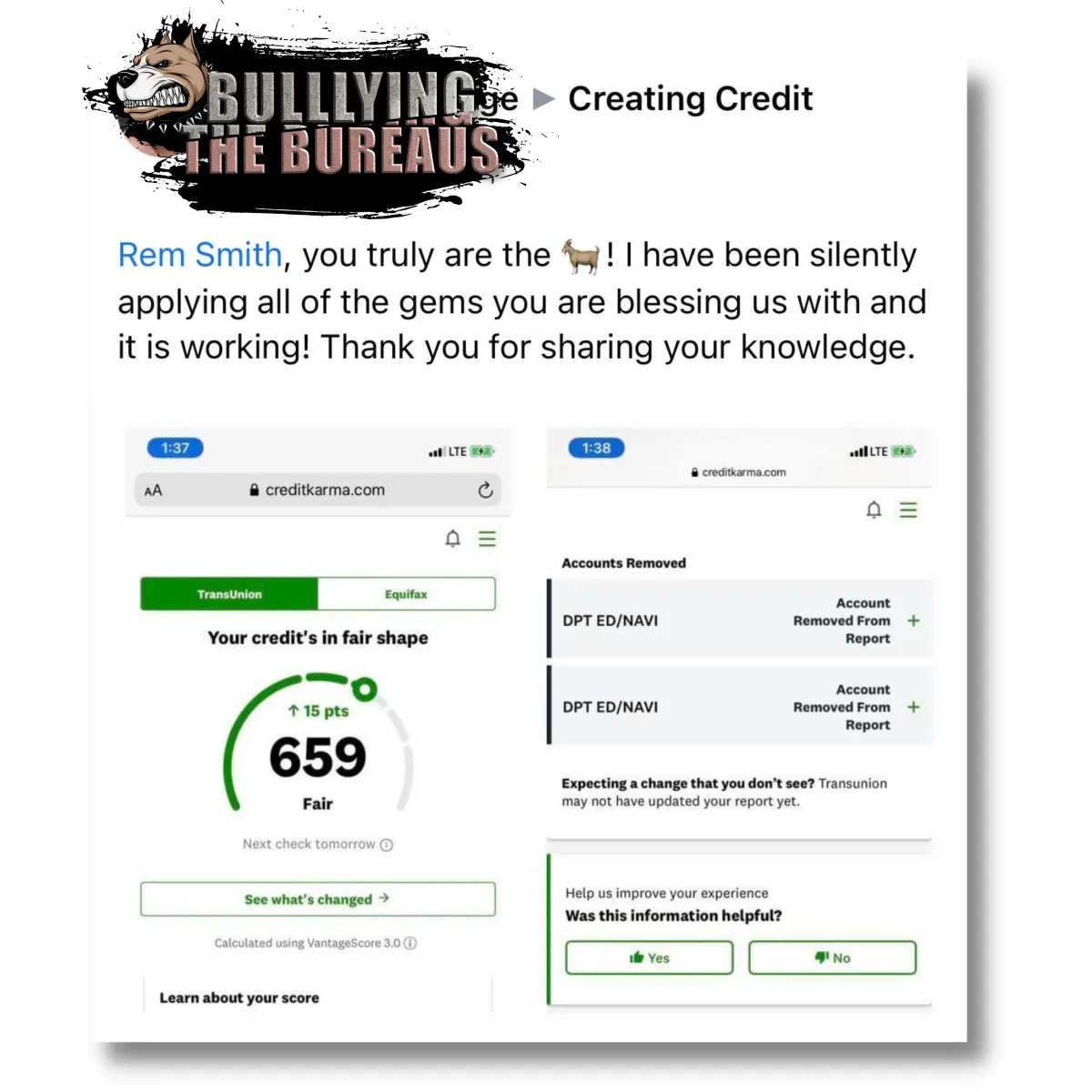

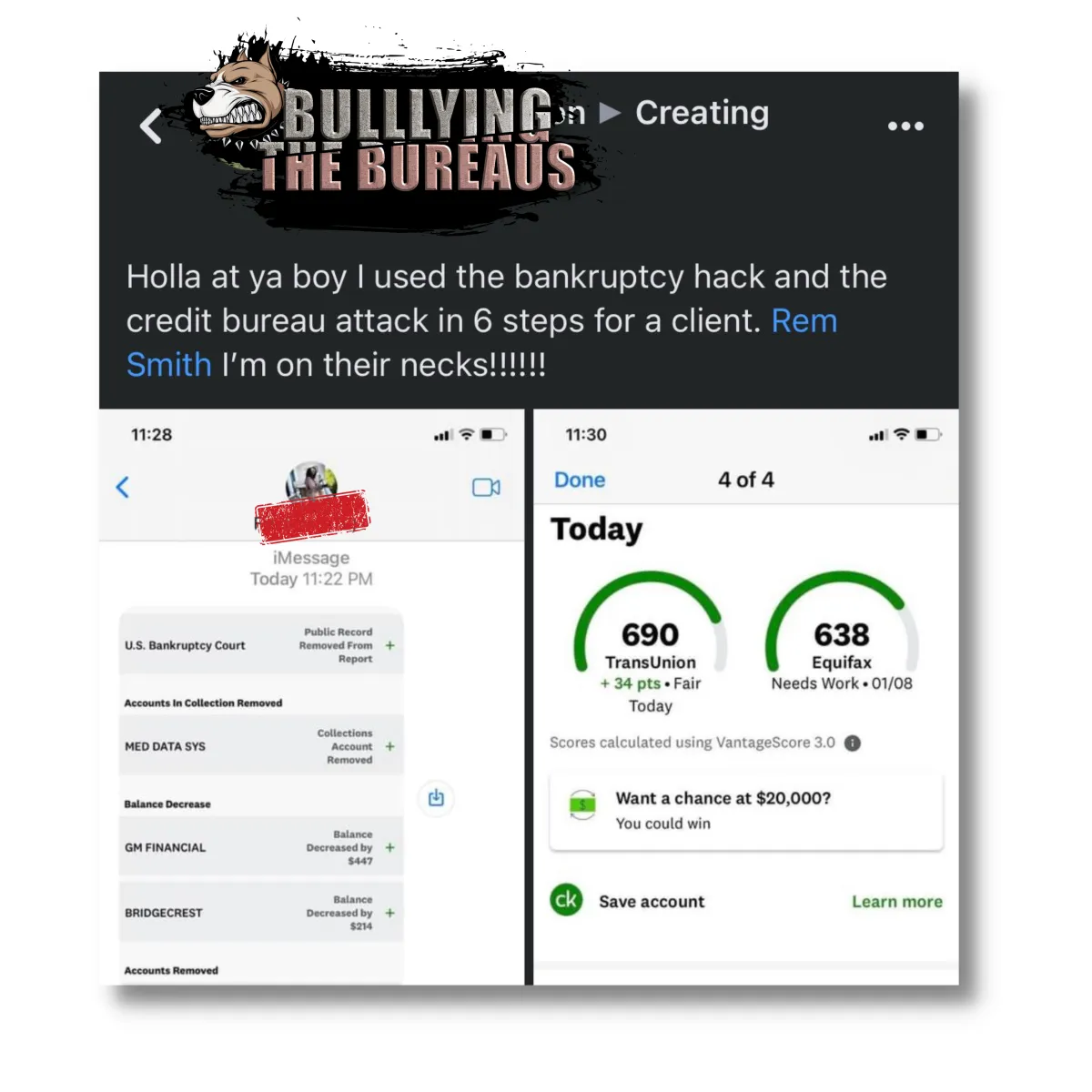

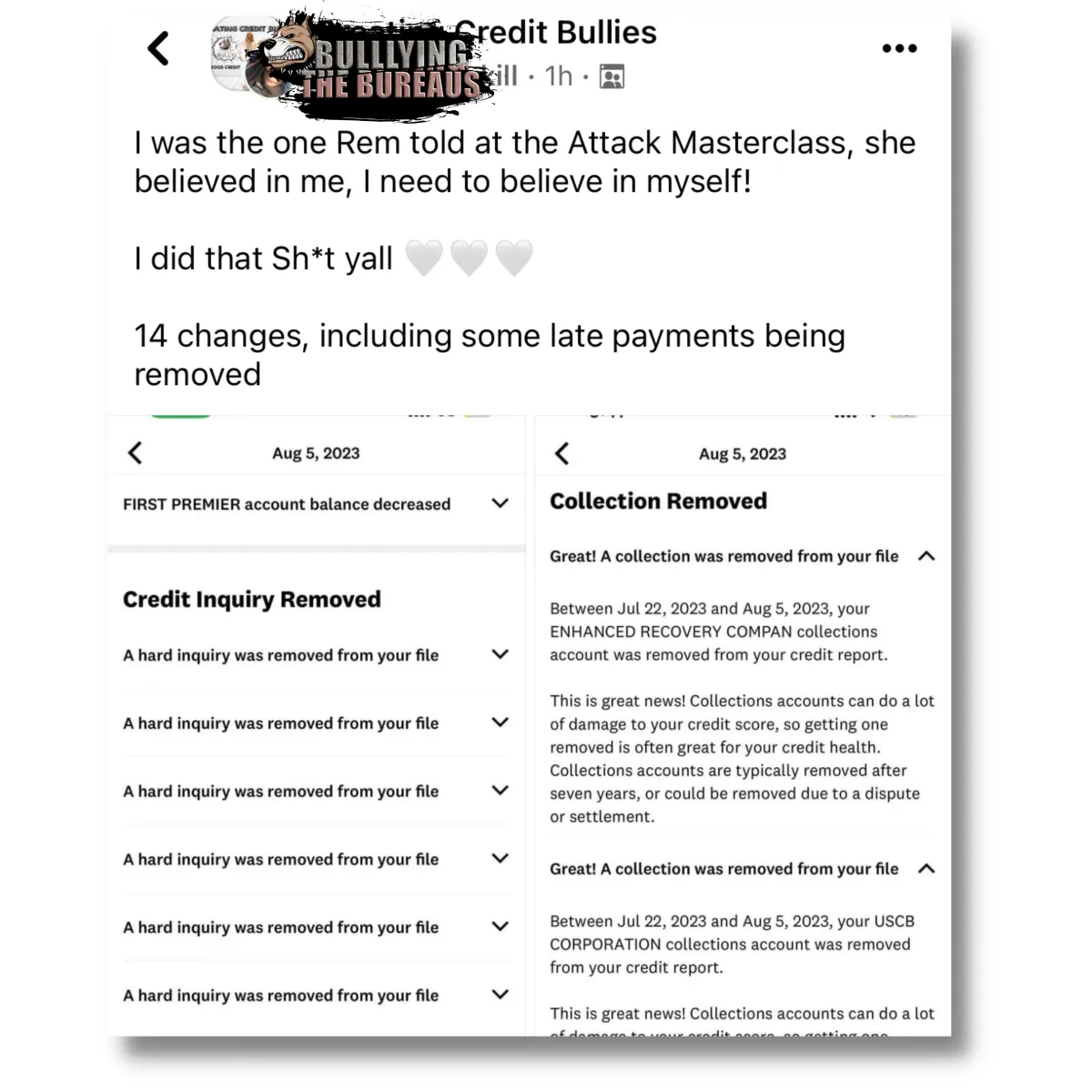

Not Sure If Our Process Works

Here Are Just A Few Results

Not Sure If Our Process Works

Here Are Just A Few Results